PROJECT DETAILS

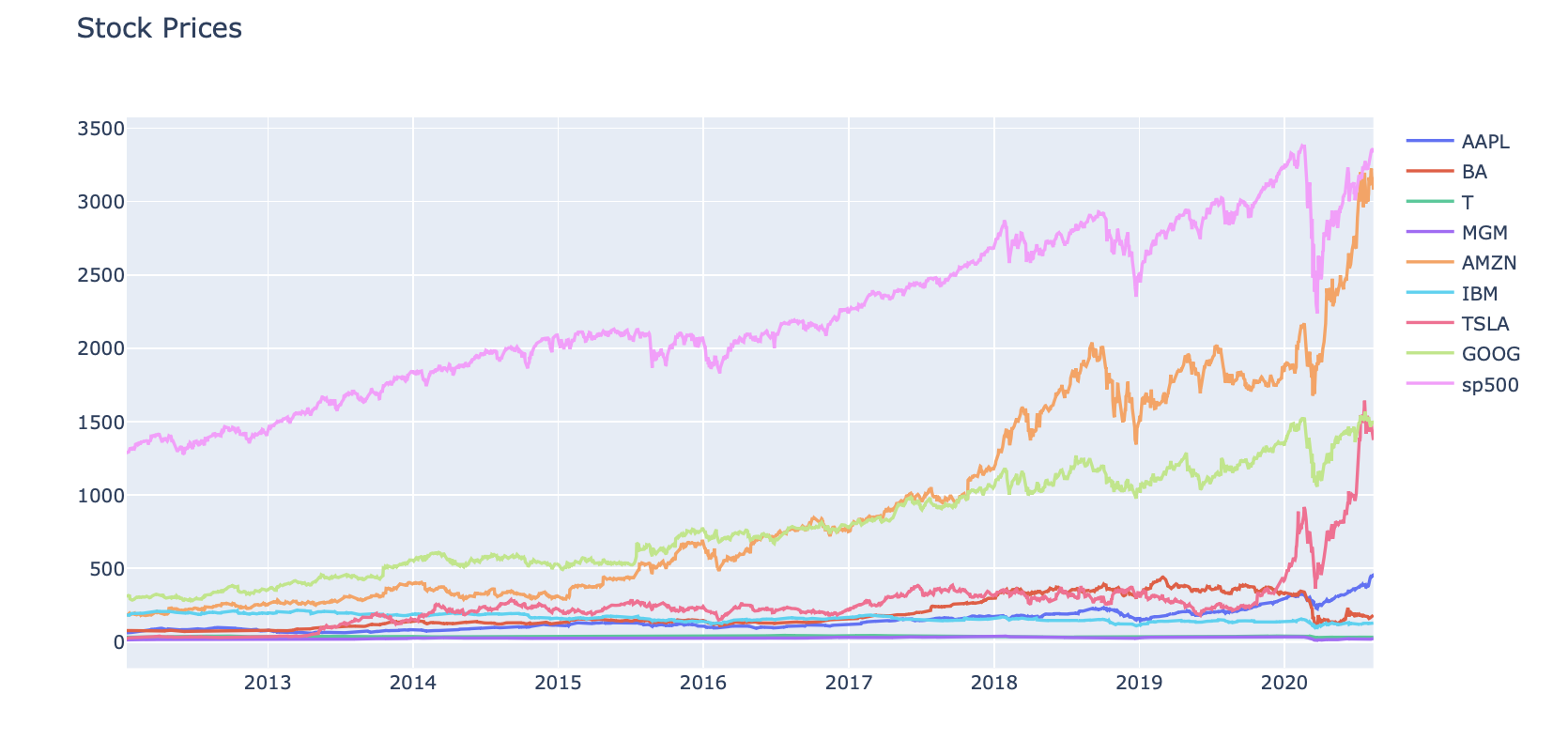

This project is on stock trading, specifically the SP500 & some very in demand stocks such as Apple, Amazon, and Google. The script will show the path that I took in order to get the most from the dataset visually and then explore a model that I found that could predict Apple’s stock to 92% accuracy. I then used the same model to the SP500 to show the ability to an index by using an LSTM model in keras. I hope you enjoy it and check out the code at my Github with the button above or share it with your network on Linkedin!

Math (Skip if you only want to see the fun stuff)

Ridge Regression is a way to create a model, when the number of predicator variables exceed the number of observations, or when the dataset has multicollinearity 🔔 (correlations between predictor variables). Also, the Ridge Regression is a L2 regression which add a penalty. The penalty is equal to the squares of the magnitude of coefficients. Penalty = Losing Money

So it is a perfect fit!

LSTM & Time Series LSTM is a recurrent neural network (RNN) that is trained by using Backpropagation through time and overcomes the vanishing gradient problem.

Long-Strong-Term Memory (LSTM) is the next generation of Recurrent Neural Network (RNN) used in deep learning for its optimized architecture to easily capture the pattern in sequential data aka STOCKS

🍻

Cheers! Now lets begin!!

IMPORT DATASETS AND LIBRARIES

# Data Maniupulation

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np

# Data Visualization

import plotly.figure_factory as ff

import plotly.express as px

# Modeling

from sklearn.preprocessing import MinMaxScaler

from sklearn.linear_model import LinearRegression

from sklearn.model_selection import train_test_split

from sklearn.linear_model import Ridge

from tensorflow import keras

# Additional

from copy import copy

from scipy import stats

# Stock prices data

stocks_df = pd.read_csv('/Users/andrewdarmond/Documents/FinanceML/stock.csv')

# Stocks volume data

stocks_vol_df = pd.read_csv('/Users/andrewdarmond/Documents/FinanceML/stock_volume.csv')

# Sort the data based on Date

stocks_df = stocks_df.sort_values('Date')

# Sort the volume data based on Date

stocks_vol_df = stocks_vol_df.sort_values('Date')

PERFORM EXPLORATORY DATA ANALYSIS AND VISUALIZATION

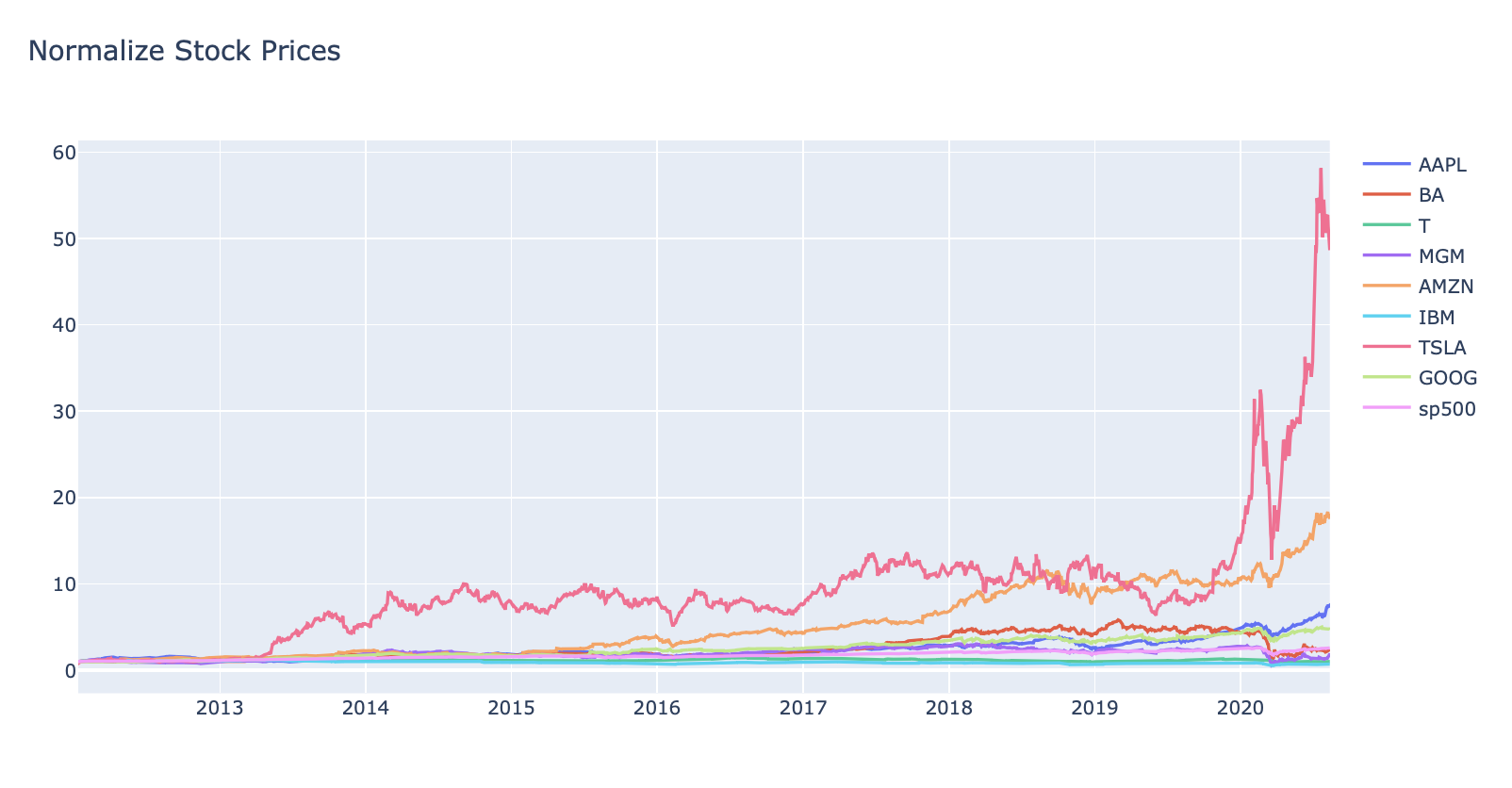

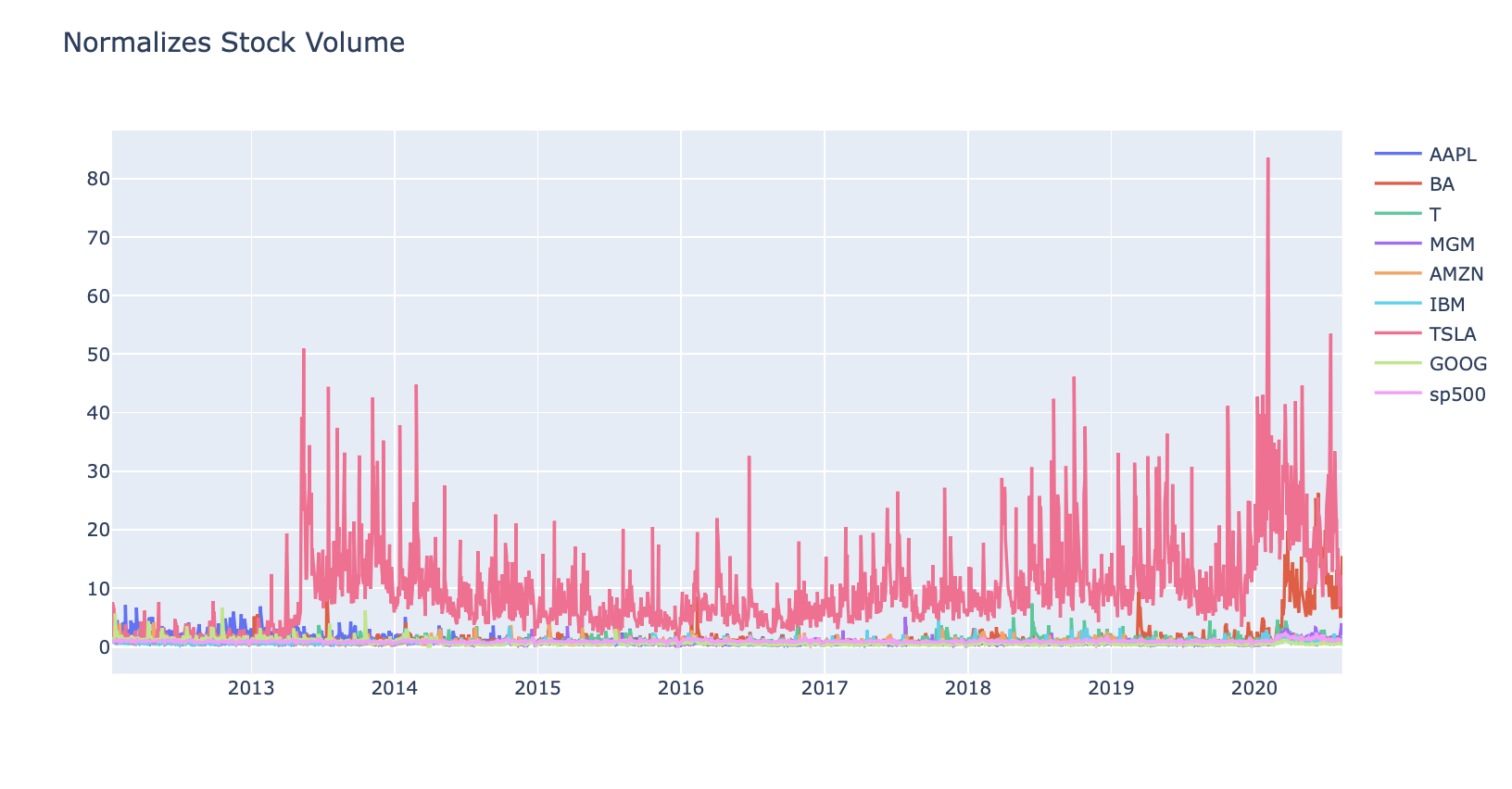

# Function to normalize stock prices based on their initial price

def normalize(df):

x = df.copy()

for i in x.columns[1:]:

x[i] = x[i]/x[i][0]

return x

# Function to plot interactive plots using Plotly Express

def interactive_plot(df, title):

fig = px.line(title = title)

for i in df.columns[1:]:

fig.add_scatter(x = df['Date'], y = df[i], name =i)

fig.show()

# plot interactive chart for stocks data

#interactive_plot(stocks_df, 'Stock Prices')

#interactive_plot(normalize(stocks_df), 'Normalize Stock Prices')

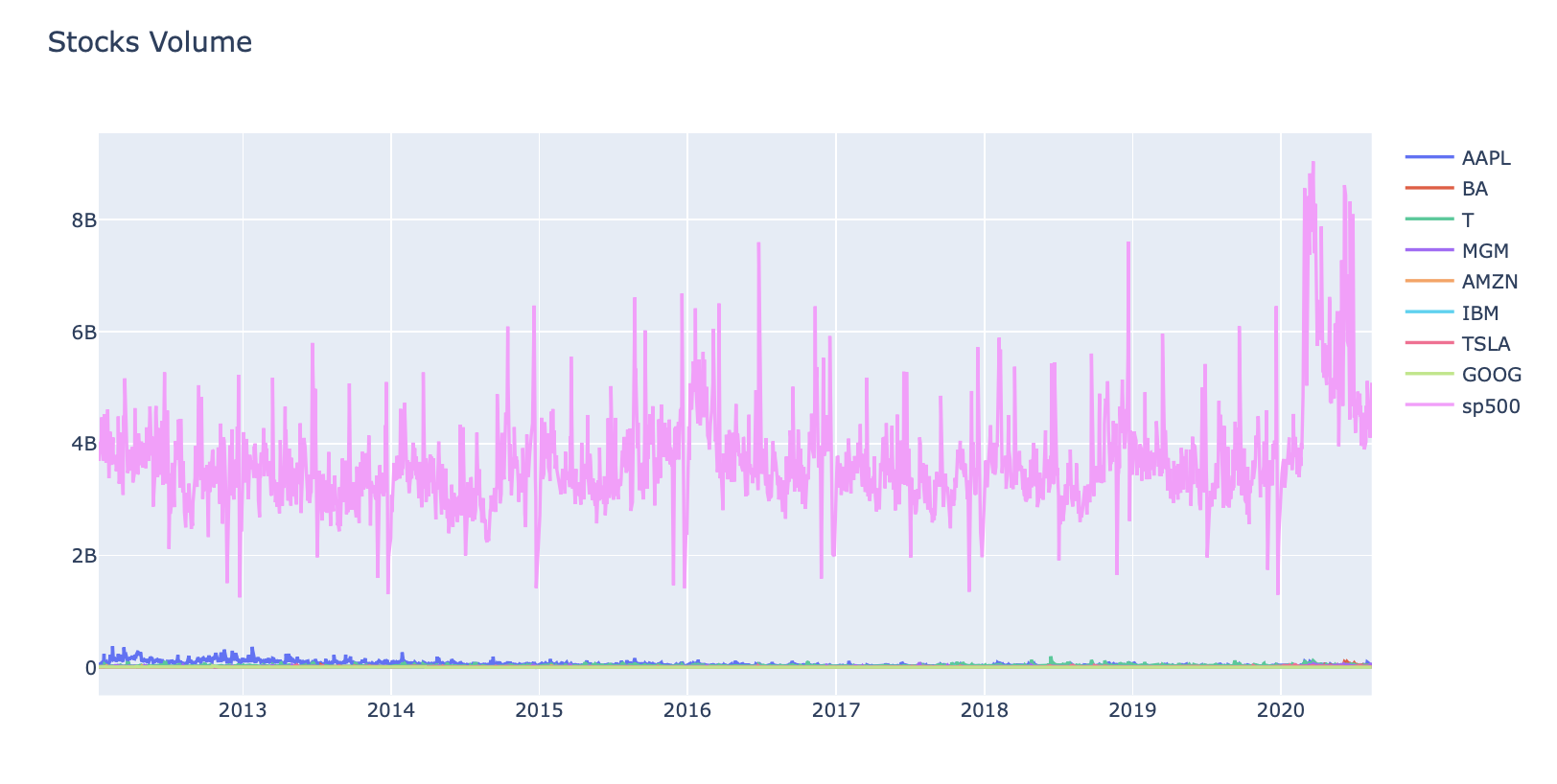

#interactive_plot(stocks_vol_df, 'Stocks Volume')

#interactive_plot(normalize(stocks_vol_df), 'Normalizes Stock Volume')

PREPARE THE DATA BEFORE TRAINING THE MODEL

# Function to concatenate the date, stock price, and volume in one dataframe

def individual_stock(price_df, vol_df, name):

return pd.DataFrame({'Date': price_df['Date'], 'Close': price_df[name], 'Volume': vol_df[name]})

# Function to return the input/output (target) data for model

# Note that our goal is to predict the future stock price

# Target stock price today will be tomorrow's price

def trading_window(data):

n = 1

data['Target'] = data[['Close']].shift(-n)

return data

If you want to view SP 500 / AMZN / ETC: Change ‘APPL’ HERE!

# Let's test the functions and get individual stock prices and volumes for AAPL

price_volume_df = individual_stock(stocks_df, stocks_vol_df, 'AAPL')

price_volume_df

| Date | Close | Volume | |

|---|---|---|---|

| 0 | 2012-01-12 | 60.198570 | 53146800 |

| 1 | 2012-01-13 | 59.972858 | 56505400 |

| 2 | 2012-01-17 | 60.671429 | 60724300 |

| 3 | 2012-01-18 | 61.301430 | 69197800 |

| 4 | 2012-01-19 | 61.107143 | 65434600 |

| ... | ... | ... | ... |

| 2154 | 2020-08-05 | 440.250000 | 30498000 |

| 2155 | 2020-08-06 | 455.609985 | 50607200 |

| 2156 | 2020-08-07 | 444.450012 | 49453300 |

| 2157 | 2020-08-10 | 450.910004 | 53100900 |

| 2158 | 2020-08-11 | 437.500000 | 46871100 |

2159 rows × 3 columns

price_volume_target_df = trading_window(price_volume_df)

price_volume_target_df

| Date | Close | Volume | Target | |

|---|---|---|---|---|

| 0 | 2012-01-12 | 60.198570 | 53146800 | 59.972858 |

| 1 | 2012-01-13 | 59.972858 | 56505400 | 60.671429 |

| 2 | 2012-01-17 | 60.671429 | 60724300 | 61.301430 |

| 3 | 2012-01-18 | 61.301430 | 69197800 | 61.107143 |

| 4 | 2012-01-19 | 61.107143 | 65434600 | 60.042858 |

| ... | ... | ... | ... | ... |

| 2154 | 2020-08-05 | 440.250000 | 30498000 | 455.609985 |

| 2155 | 2020-08-06 | 455.609985 | 50607200 | 444.450012 |

| 2156 | 2020-08-07 | 444.450012 | 49453300 | 450.910004 |

| 2157 | 2020-08-10 | 450.910004 | 53100900 | 437.500000 |

| 2158 | 2020-08-11 | 437.500000 | 46871100 | NaN |

2159 rows × 4 columns

# Remove the last row as it will be a null value

price_volume_target_df = price_volume_target_df[:-1]

price_volume_target_df

| Date | Close | Volume | Target | |

|---|---|---|---|---|

| 0 | 2012-01-12 | 60.198570 | 53146800 | 59.972858 |

| 1 | 2012-01-13 | 59.972858 | 56505400 | 60.671429 |

| 2 | 2012-01-17 | 60.671429 | 60724300 | 61.301430 |

| 3 | 2012-01-18 | 61.301430 | 69197800 | 61.107143 |

| 4 | 2012-01-19 | 61.107143 | 65434600 | 60.042858 |

| ... | ... | ... | ... | ... |

| 2153 | 2020-08-04 | 438.660004 | 43267900 | 440.250000 |

| 2154 | 2020-08-05 | 440.250000 | 30498000 | 455.609985 |

| 2155 | 2020-08-06 | 455.609985 | 50607200 | 444.450012 |

| 2156 | 2020-08-07 | 444.450012 | 49453300 | 450.910004 |

| 2157 | 2020-08-10 | 450.910004 | 53100900 | 437.500000 |

2158 rows × 4 columns

# Scale the data

sc = MinMaxScaler(feature_range = (0,1))

price_volume_target_scaled_df = sc.fit_transform(price_volume_target_df.drop(columns = ['Date']))

# Create Feature and Target

X = price_volume_target_scaled_df[:, :2]

y = price_volume_target_scaled_df[:, 2:]

price_volume_target_scaled_df.shape

(2158, 3)

X.shape, y.shape

((2158, 2), (2158, 1))

Spliting the data this way, since order is important in time-series

Note that we did not use train test split with it’s default settings since it shuffles the data

split = int(0.75 * len(X))

X_train = X[:split]

y_train = y[:split]

X_test = X[split:]

y_test = y[split:]

X_train.shape, y_train.shape

((1618, 2), (1618, 1))

X_test.shape, y_test.shape

((540, 2), (540, 1))

# Define a data plotting function

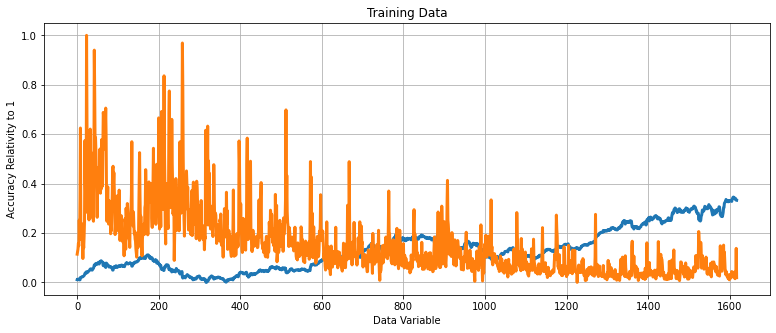

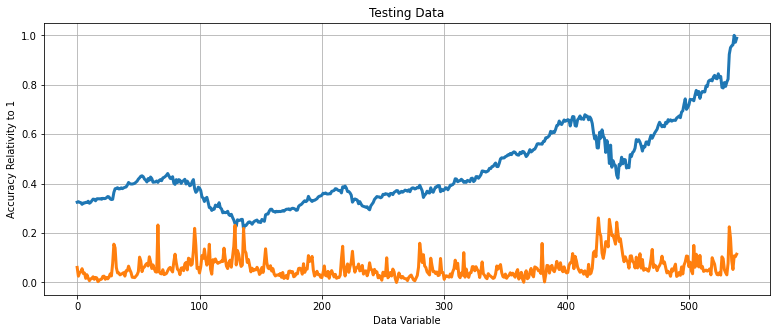

print('''

APPLE

''')

def show_plot(data, title):

plt.figure(figsize = (13, 5))

plt.plot(data, linewidth = 3)

plt.title(title)

plt.xlabel(xlabel= 'Data Variable')

plt.ylabel(ylabel= 'Accuracy Relativity to 1' )

plt.grid()

show_plot(X_train, 'Training Data')

show_plot(X_test, 'Testing Data')

APPLE

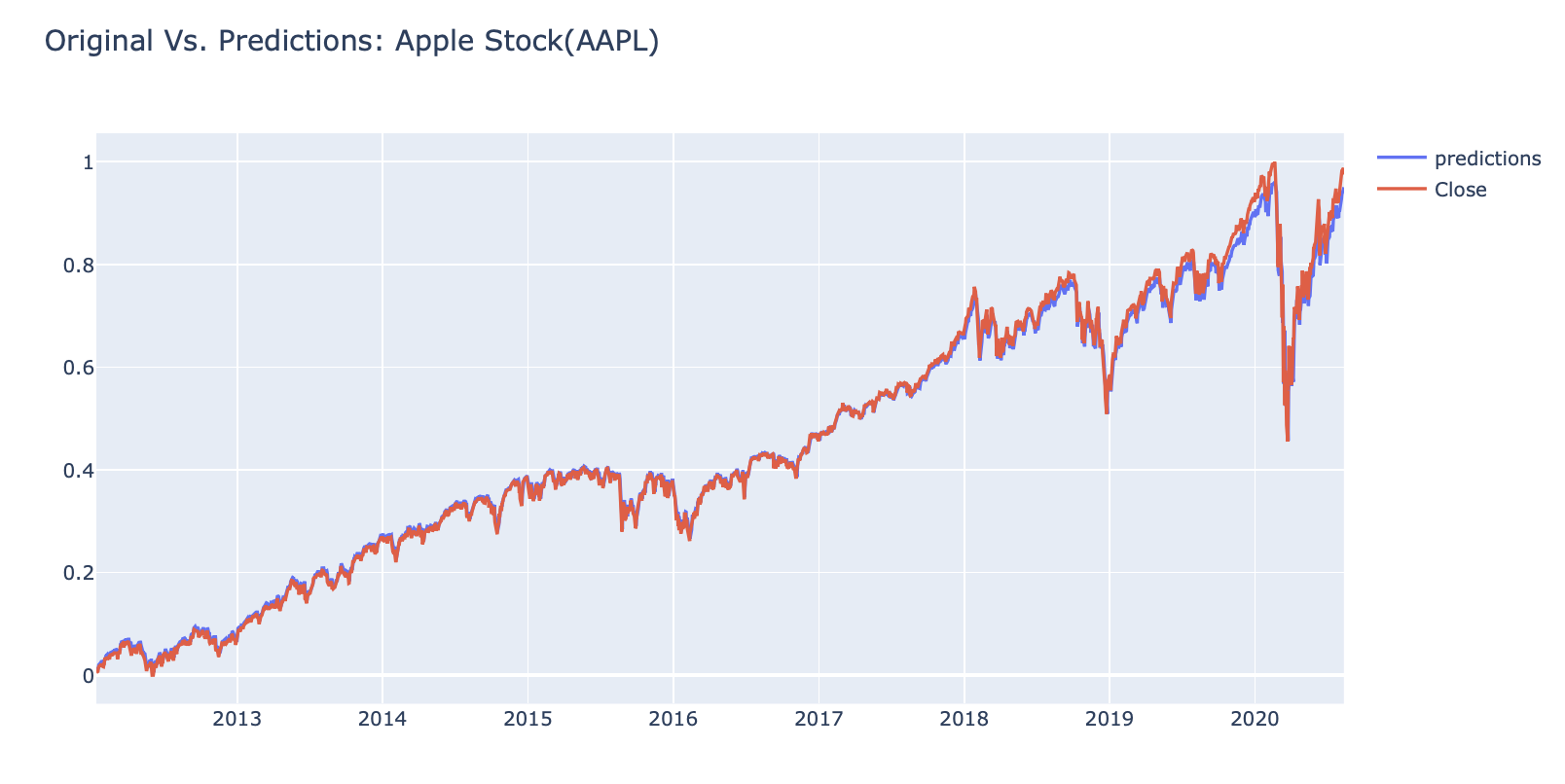

BUILD AND TRAIN A RIDGE LINEAR REGRESSION MODEL

regression_model = Ridge()

# Test the model and calculate its accuracy

regression_model.fit(X_train, y_train)

# Make Prediction

lr_accuracy = regression_model.score(X_test, y_test)

print('Ridge Regression Score:', lr_accuracy)

Ridge Regression Score: 0.9311227075637692

# Append the predicted values into a list

predicted_prices = regression_model.predict(X)

predicted = []

for i in predicted_prices:

predicted.append(i[0])

# Append the close values to the list

close = []

for i in price_volume_target_scaled_df:

close.append(i[0])

# Create a dataframe based on the dates in the individual stock data

df_predicted = price_volume_target_df[['Date']]

# Add the close values to the dataframe

df_predicted['Close'] = close

# Add the predicted values to the dataframe

df_predicted['Prediction'] = predicted

df_predicted

| Date | Close | Prediction | |

|---|---|---|---|

| 0 | 2012-01-12 | 0.011026 | 0.026286 |

| 1 | 2012-01-13 | 0.010462 | 0.025428 |

| 2 | 2012-01-17 | 0.012209 | 0.026527 |

| 3 | 2012-01-18 | 0.013785 | 0.027022 |

| 4 | 2012-01-19 | 0.013299 | 0.026992 |

| ... | ... | ... | ... |

| 2153 | 2020-08-04 | 0.957606 | 0.866550 |

| 2154 | 2020-08-05 | 0.961583 | 0.871436 |

| 2155 | 2020-08-06 | 1.000000 | 0.903353 |

| 2156 | 2020-08-07 | 0.972088 | 0.878730 |

| 2157 | 2020-08-10 | 0.988245 | 0.892666 |

2158 rows × 3 columns

# Plot the results

#interactive_plot(df_predicted, 'Original Vs. Predictions: Apple Stock(AAPL)')

TRAIN AN LSTM TIME SERIES MODEL

If you want to view APPL / AMZN / ETC: Change ‘sp500 HERE!

# Let's test the functions and get individual stock prices and volumes for sp500

price_volume_df = individual_stock(stocks_df, stocks_vol_df, 'sp500')

# Get the close and volume data as training data (Input)

training_data = price_volume_df.iloc[:, 1:3].values

# Normalize the data

sc = MinMaxScaler(feature_range= (0,1))

training_set_scaled = sc.fit_transform(training_data)

# Create the training and testing data, training data contains present day and previous day values

X = []

y = []

for i in range(1, len(price_volume_df)):

X.append(training_set_scaled[i-1:i, 0])

y.append(training_set_scaled[i, 0])

# Convert the data into array format

X = np.array(X)

y = np.array(y)

# Split the data

split = int(0.7 * len(X))

X_train = X[:split]

y_train = y[:split]

X_test = X[split:]

y_test = y[split:]

# Reshape the 1D arrays to 3D arrays to feed in the model

X_train = np.reshape(X_train, (X_train.shape[0], X_train.shape[1], 1))

X_test = np.reshape(X_test, (X_test.shape[0], X_test.shape[1], 1))

# Create the model

inputs = keras.layers.Input(shape=(X_train.shape[1], X_train.shape[2]))

x = keras.layers.LSTM(150, return_sequences= True)(inputs)

x = keras.layers.Dropout(0.3)(x)

x = keras.layers.LSTM(150, return_sequences=True)(x)

x = keras.layers.Dropout(0.3)(x)

x = keras.layers.LSTM(150)(x)

outputs = keras.layers.Dense(1, activation='linear')(x)

model = keras.Model(inputs=inputs, outputs=outputs)

model.compile(optimizer='adam', loss="mse")

model.summary()

Model: "model"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

input_1 (InputLayer) [(None, 1, 1)] 0

_________________________________________________________________

lstm (LSTM) (None, 1, 150) 91200

_________________________________________________________________

dropout (Dropout) (None, 1, 150) 0

_________________________________________________________________

lstm_1 (LSTM) (None, 1, 150) 180600

_________________________________________________________________

dropout_1 (Dropout) (None, 1, 150) 0

_________________________________________________________________

lstm_2 (LSTM) (None, 150) 180600

_________________________________________________________________

dense (Dense) (None, 1) 151

=================================================================

Total params: 452,551

Trainable params: 452,551

Non-trainable params: 0

_________________________________________________________________

# Train the model

history = model.fit(X_train, y_train, epochs= 20, batch_size= 32, validation_split= 0.2)

Epoch 1/20

38/38 [==============================] - 7s 55ms/step - loss: 0.0539 - val_loss: 0.0653

Epoch 2/20

38/38 [==============================] - 0s 8ms/step - loss: 0.0095 - val_loss: 0.0055

Epoch 3/20

38/38 [==============================] - 0s 11ms/step - loss: 0.0012 - val_loss: 5.9507e-04

Epoch 4/20

38/38 [==============================] - 0s 10ms/step - loss: 3.8284e-04 - val_loss: 2.3346e-04

Epoch 5/20

38/38 [==============================] - 0s 9ms/step - loss: 3.5239e-04 - val_loss: 8.1833e-05

Epoch 6/20

38/38 [==============================] - 0s 10ms/step - loss: 3.5036e-04 - val_loss: 6.2046e-05

Epoch 7/20

38/38 [==============================] - 0s 8ms/step - loss: 3.0313e-04 - val_loss: 4.0566e-05

Epoch 8/20

38/38 [==============================] - 0s 9ms/step - loss: 2.8564e-04 - val_loss: 6.2951e-05

Epoch 9/20

38/38 [==============================] - 0s 9ms/step - loss: 3.1342e-04 - val_loss: 5.7098e-05

Epoch 10/20

26/38 [===================>..........] - ETA: 0s - loss: 2.9808e-04

# Make prediction

predicted = model.predict(X)

test_predicted = []

for i in predicted:

test_predicted.append(i[0])

df_predicted = price_volume_df[1:][['Date']]

df_predicted['predictions'] = test_predicted

close = []

for i in training_set_scaled:

close.append(i[0])

df_predicted['Close'] = close[1:]

df_predicted

# Plot the results

#interactive_plot(df_predicted, 'Original Vs Predictions: SP500')